Personalization & Life Stage Guidance

Eternal Vault helps you focus on what matters most by understanding your current life stage and priorities. Our personalization system ensures you’re working on the right documents first, making your digital legacy setup both efficient and comprehensive.

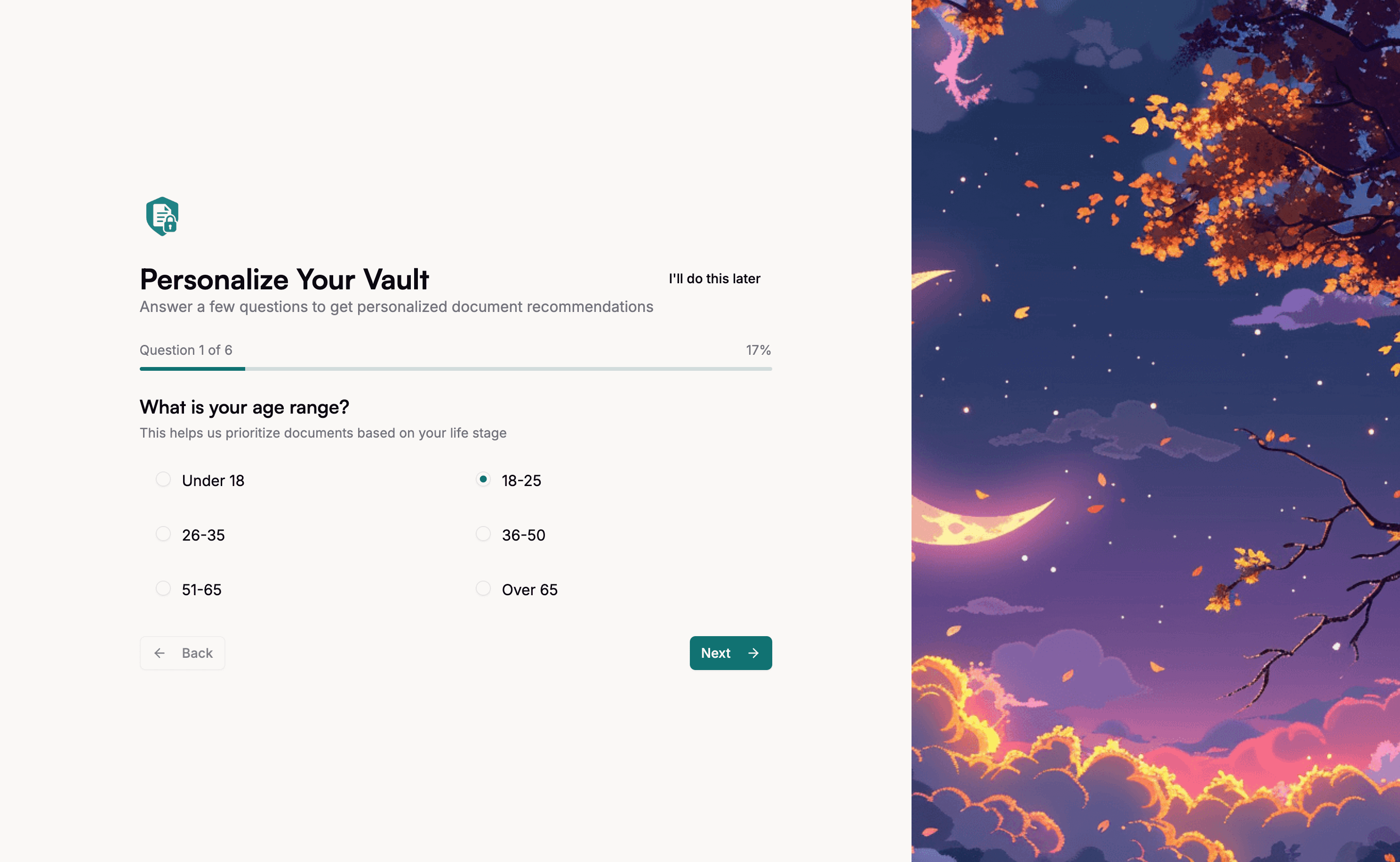

The Personalization Questionnaire

After completing your initial setup, you’ll be guided through a brief questionnaire that helps us understand:

- Your current life stage (single, married, new parent, established family, etc.)

- Your priorities (financial security, family protection, business continuity)

- Your existing preparation (do you have a will, insurance, emergency plans)

- Your family situation (dependents, care responsibilities, complex arrangements)

What Makes This Different

Unlike generic checklists, our system adapts to your responses and creates a personalized roadmap that focuses on your most critical needs first.

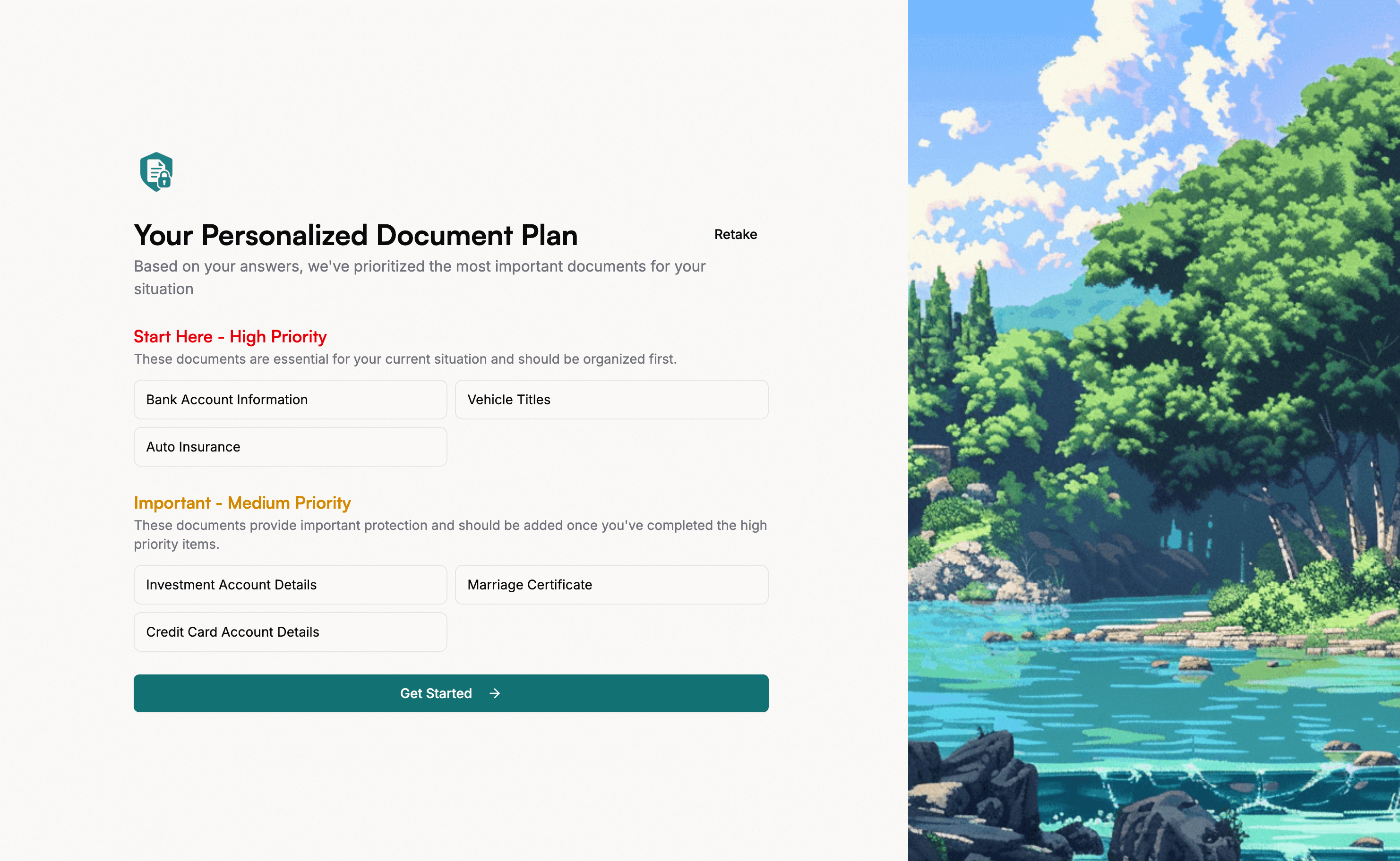

Personalized Recommendations

Based on your questionnaire responses, you’ll receive:

Priority Document Categories

Your dashboard will highlight which document types are most urgent for your situation:

- High Priority: Documents you should upload first

- Medium Priority: Important but can wait a few weeks

Updating Your Personalization

Life changes, and so should your priorities. You can retake the personalization questionnaire anytime:

When to Update

- Major life events: Marriage, divorce, new children, job changes

- Financial changes: New assets, business ownership, inheritance

- Family changes: Aging parents, dependent care needs

- Health changes: New medical conditions, care requirements

How to Update

- On your dashboard page, click on Update Preferences in the Essential Documents section

- Answer the updated questionnaire

- Review your new recommendations

Review and update your personalization every 6-12 months or after any major life change. This ensures your priorities stay current and relevant.

Making the Most of Personalization

Start Small, Build Systematically

- Focus on your high priority documents first

- Don’t feel overwhelmed by the complete list

- Celebrate progress as you complete each category

Use the Context

- Read the “Why this matters” explanations

- Understand how each document protects your family

- Use the provided templates and examples

Stay Flexible

- Your personalization is a guide, not a rigid rule

- Feel free to add documents outside your recommendations

- Adjust based on your family’s unique needs

Common Questions

Q: What if I don’t fit into standard categories?

A: Our questionnaire includes options for complex family situations, blended families, and unique circumstances. You can also skip recommendations that don’t apply.

Q: Can I see all document types, not just my recommendations?

A: Absolutely! Your personalized view is just the starting point. You can browse and add any document type from our complete library.

Q: How often should I review my personalization?

A: We recommend reviewing it every 6-12 months or after major life changes. Your dashboard will remind you when it might be time for an update.

Ready to get personalized guidance? If you haven’t completed the questionnaire yet, you’ll be prompted after your initial onboarding is complete. Already have an account? Check your dashboard for personalized recommendations!